Almost every aspect of our life is routed through a central clearinghouse before it reaches us. Our money is dispensed through banks, our electricity is controlled by power companies, and the webpages we access are filtered by Google. However, massive security breaches, transparency concerns, and a desire for tighter control of personal information are pushing people to design different ways to interact. Behind the scenes, a group of hacker activists have been working on this problem for decades, dreaming of a world composed of millions of devices connected in a transparent yet privacy-protecting network, a place where everyone has access and can contribute.

Towards this end, in 2008, an unknown programmer called Satoshi Nakamoto published a paper to an obscure cryptography mailing list describing a new type of currency. One that would not be controlled by banks but by individuals who interact directly with each other. He called it Bitcoin. Bitcoin has since exploded, making millionaires, creating a cryptocurrency arms race, and redefining the definition of currency. But underlying Bitcoin is a potentially groundbreaking technology called the blockchain.

The blockchain, a distributed ledger which records interactions between people, offers a mechanism for decentralization, transparency, and security. Its impact reaches far beyond Bitcoin, and promises to be influential in fields from human trafficking to smart electrical grids to electronic voting. As criminals switched to Bitcoin to hide their illicit transactions, law enforcement developed ways to follow their activities by tracking them along the blockchain. Blockchains are also transforming the way electricity is shared, allowing movement away from large power plants to smaller local sources which are controlled by the electricity users. Even the political sphere is looking into incorporating blockchains to promote open and verifiable electronic voting. In all of these scenarios, the blockchain, branching out from its cryptocurrency roots, has too much promise and power to be easily dismissed.

The structure of the blockchain

Every year, we spend more time online, buying products off Amazon, watching TV shows on Netflix, and exchanging money through Venmo. Each of these companies record our transactions and build portfolios of everything we buy, watch, and click on. However, these companies are vulnerable, and our personal information can easily be compromised. Last year, the credit rating agency Equifax discovered that hackers stole personal information from 143 million US customers, and just recently Facebook data on tens of millions of users was harvested without their knowledge and used by a data analytics firm for political purposes.

This corporate trove of personal data makes many very uncomfortable. In the early 1990s, a group of seemingly innocuous, San Francisco-based computer scientists-turned anarchist hackers called cypherpunks banded together to find digital solutions to protect individual privacy. They viewed privacy as a necessity, declaring, “We know that someone has to write software to defend privacy, and…we’re going to write it.” Towards this pursuit, they pioneered ways for people to communicate, exchange, and exist anonymously online. Out of this pursuit came the blockchain.

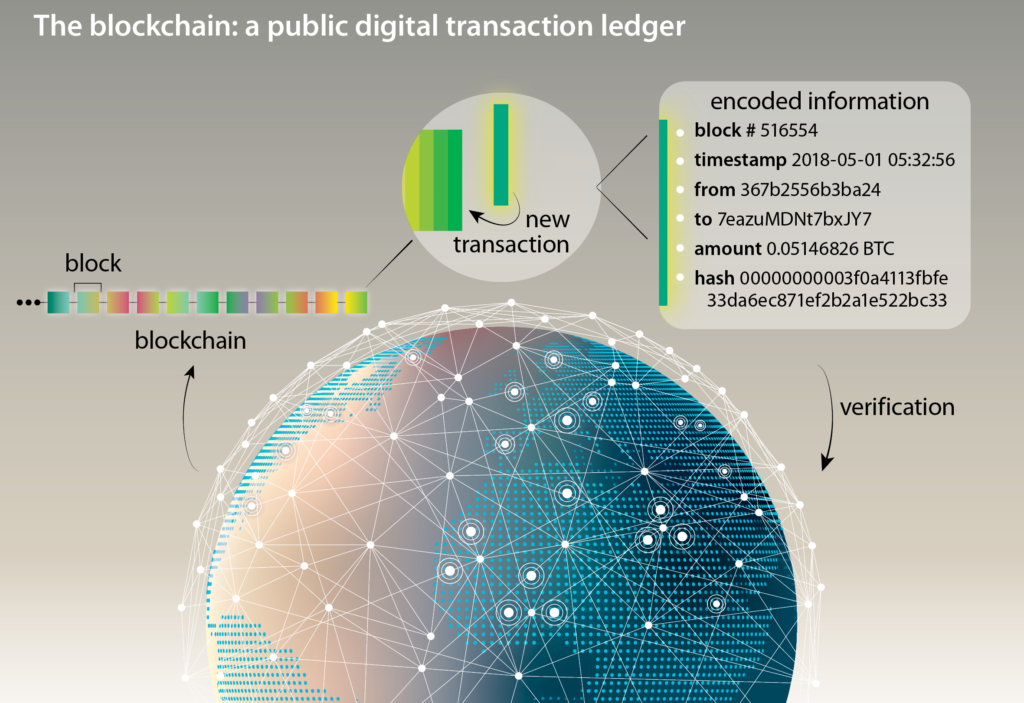

A blockchain is a permanent digital ledger, a database of all transactions between users. The transfer of a property deed, exchange of money for a service, or a donation to a charity can all be recorded on a blockchain. Transactions occurring within a certain period of time are lumped into a list called a block. The whole ledger is a chain of all these blocks, giving it its moniker: the blockchain.

A copy of the blockchain is saved on millions of independent computers called nodes. In order to record a transaction on the blockchain, the parties performing the transaction declare their intent to the nodes, and the nodes must agree that the transaction is valid. If someone wants to falsify a transaction (such as sending fake Bitcoins to someone), all copies of the blockchain must be altered in full view of anyone watching, making the blockchain extremely difficult to hack. Knowing the blockchain is attack- resistant—and that all transactions are public and thus transparent—minimizes the amount of trust participants need to have in each other. Instead, they trust the blockchain, where transactions are secured and verified by mass consensus. The blockchain is stored on each of the nodes, distributing the responsibility of maintaining the network and reducing its susceptibility to centralized failure or corruption.

Bitcoin and the blockchain

The blockchain is a continuously growing list of records, called blocks, that record transaction data. Blocks are linked together and secured using cryptrography. Blockchain copies are stored throughout the network and are constantly cross-checked to preserve data validity. Credit: Nicole Repina

The blockchain is a continuously growing list of records, called blocks, that record transaction data. Blocks are linked together and secured using cryptrography. Blockchain copies are stored throughout the network and are constantly cross-checked to preserve data validity. Credit: Nicole Repina

The formation of a secure and open technology such as the blockchain opens the door to many potential uses. Its first has been to the world of currency. Andrew Tu, the head of marketing for the student organization Blockchain at Berkeley, believes that finance “will likely remain one of the most important applications of the blockchain.”

Bitcoin could not exist without the blockchain. In the past, currency came in either the form of physical goods, like gold, or fiat currency, like government-backed paper money. Cryptocurrencies, long-sought by cypherpunks, are a form of digital money that is protected by cryptographic algorithms and give control of the money back to the people, away from governments and banks. A number of cryptocurrencies were attempted before Bitcoin, but unfortunately their digital nature was both their advantage and their downfall.

Digital currencies, like pictures, texts, and ebooks, are not tied to a physical object. They are simply code. If the code for a dollar acted the same as the code for a text, nothing would prevent people from copying the dollar’s code and spending it as many times as they wanted. Failure to adequately solve this problem undoes past attempts to develop a viable cryptocurrency. In contrast, most traditional online monetary transactions require a trusted third-party, like Visa, who keeps a ledger recording who owned what. This ledger ensures that money is spent only once.

With the help of the blockchain, cryptocurrencies like Bitcoin can now protect transactions without a third party. When someone owns a Bitcoin, their Bitcoin is stored in a digital wallet that has its own address. You send Bitcoins to someone’s wallet address much like emails are sent to an email address. When making a purchase using Bitcoin, that Bitcoin is checked against the blockchain to ensure that it hasn’t already been spent. Once the transaction is verified, volunteers called Bitcoin miners add the new transaction to the blockchain, recording who sent the Bitcoins, how much was sent, and who received it—this is called Bitcoin mining. Once the mining is complete, the transaction is publically and permanently available on the blockchain. The verification process and public nature of the blockchain make Bitcoins very difficult to counterfeit. As a result, the blockchain enables Bitcoin to be an uncopiable digital object and the first successful cryptocurrency.

To prevent a malicious miner from adding false blocks and slow down the pace of mining, the process of mining is designed to be computationally expensive. In 2017, Bitcoin mining consumed 36 terawatt hours of energy, enough to power 3 million homes for a year in the US. This makes mining accessible only to those who own a lot of computing power or can rent computing power from a company through cloud mining. However, adding transactions is vital to the operation of the blockchain, so miners are incentivized to perform this task by being rewarded with Bitcoins.

In 2010, the price of one Bitcoin was less than 1 cent and Bitcoins were used mostly by cypherpunks. By the end of 2017, the price climbed by a staggering amount to nearly $20,000. Individuals, companies, and countries now are avidly pursuing this “next generation gold.” As its use has become more widespread, major companies like Microsoft began accepting Bitcoin as payment, data centers offer online mining operations and charge for a specific amount of computing power, and governments are beginning to investigate the effects of cryptocurrencies on their economies.

However, there is a darker side to Bitcoin and the blockchain. Bitcoin does have characteristics that make it attractive for criminal activity. The digital wallets that hold people’s Bitcoins are not anonymous. They are pseudonymous. The transactions on the blockchain are visible to anyone, but users do not have to put their real name on their wallets so it is unclear who made a particular transaction. In addition, Bitcoin also offers no way to cancel or reverse transactions once they are on the blockchain. The only way someone can get their money back is to agree to a new transaction. If a user has been scammed, there is no central establishment that can insure them. These features provide new opportunities for those profiting from exploitation.

Using blockchains to stop human traffickers

Organized crime and illicit markets form a trillion-dollar business. Human trafficking is the third largest criminal activity, with 21 million victims around the world forced into this modern form of slavery. Traffickers profit from organ harvesting, forced marriages and labor. However, sexual exploitation makes up the largest part of this market and is one of the fastest-growing organized criminal activities.

Sexual advertisements can be placed on platforms like Craigslist and Facebook, but most are found on the ad-listing site Backpage. While Backpage offers advertisements on many different products, it is also the hub for sexual services, both voluntary and by traffickers. The US National Center for Missing and Exploited Children discovered that most of the sex trafficking cases involving children were advertised on Backpage.

In a campaign to help stop sex trafficking, the credit card companies MasterCard, American Express, and Visa stopped processing payments for adult-service advertisements on the site. Backpage responded by turning to Bitcoin and other cryptocurrencies as an alternative, bypassing corporate and government control. Through Bitcoin, traffickers can take advantage of the cryptocurrency’s near anonymity.

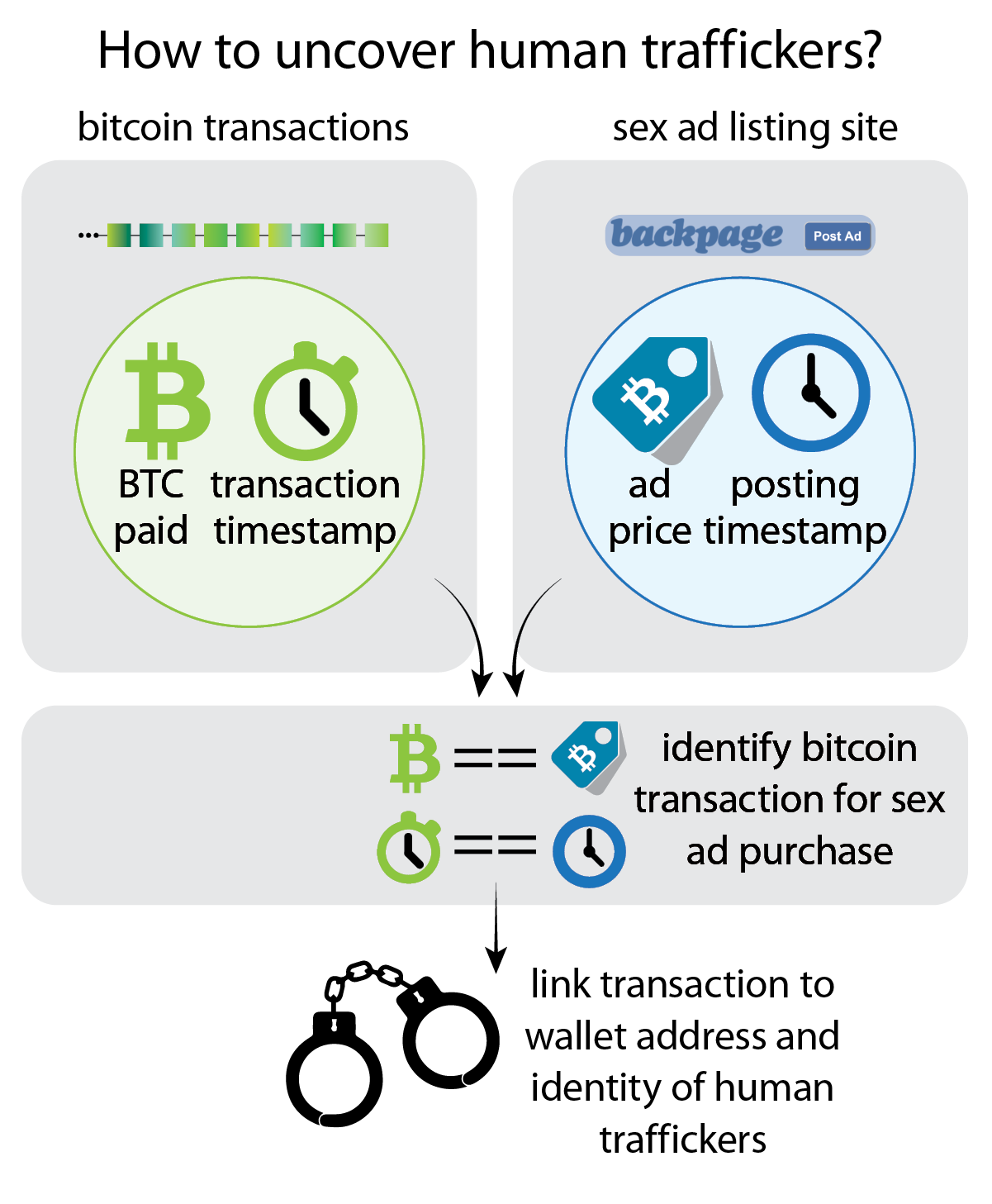

However, a research group spanning UC Berkeley, New York University, and UC San Diego was able to unveil traffickers using Bitcoin. By observing specific transactions on the blockchain, these researchers linked Bitcoin transactions from a trafficker’s wallet to illicit Backpage advertisements.

Bitcoin blockchain data is compared to sex ad posting data from Backpage to identify bitcoin transactions. Data with similar monetary values and timestamps are linked, uncovering the bitcoin wallet address of the ad poster. Law enforcement then links the wallet address to physical identity of human traffickers. Credit: Nicole Repina

Bitcoin blockchain data is compared to sex ad posting data from Backpage to identify bitcoin transactions. Data with similar monetary values and timestamps are linked, uncovering the bitcoin wallet address of the ad poster. Law enforcement then links the wallet address to physical identity of human traffickers. Credit: Nicole Repina

On Backpage, a user can post an ad for free, but some features, like placing the ad at the top of the listings page, have a cost. In general, after a Bitcoin purchase, the transaction is verified and added to the blockchain. Usually this process lasts a couple of minutes, but during times of high volume, it can take days. In the time between the transaction and the validation, the transaction sits in a temporary storage location called a memory pool, or mempool. Some merchants will wait until the transaction has been added to the blockchain for verification of legitimacy, but other merchants will accept the transaction as long as they see it in the mempool. Not waiting for the transaction to be fully completed speeds up the process, but it also skips a very important step. As Danny Y. Huang, who worked on this team and specialized in tracking the blockchain, explains, “while Backpage provides convenience to users, it also backfires as it leaks users’ information.” The mempool inadvertently provides a wealth of information about the transactions.

Once Backpage sees the transaction in the mempool, “instead of waiting for Bitcoin transactions to be fully confirmed into the blockchain,” Huang describes, “Backpage simply accepts a pending Bitcoin transaction as confirmed and immediately posts the ad.” And, as proved useful to the researchers, the ad has a timestamp.

The mempool, like the blockchain, is publically available. The researchers developed an algorithm that recorded the mempool and all its transactions every minute. If the timestamp on the Backpage ad said it was posted at 11:45 a.m., they looked at the 11:45 a.m. mempool record to find who made transactions during that time period. For instance, imagine Bob bought a Backpage ad at 11:45 a.m. At the same time, Tom bought a blanket from Etsy, and Alice purchased a game from Steam. All of these transactions appear in the same recorded mempool snapshot.

Once the transactions enter the blockchain, researchers learn the address of the buyer’s wallet, the address of the seller’s wallet, and the amount of Bitcoins spent. The challenge then becomes how to identify Bob’s transaction as a payment to Backpage and to differentiate Bob’s transaction from Tom’s and Alice’s. This step is possible because Bitcoin transactions are not fully anonymous.

“The blockchain,” says Doefler, “is like if everyone had a record of every credit card transaction but they just only had the credit card number and merchant ID.” Normally, that information alone is not enough to trace transactions. But with the help of a company called Chainalysis, a startup that helps companies and government agencies hunt for cryptocrime, Doefler and the other authors can analyze transactions on the blockchain.

Chainalysis first makes a payment to Backpage. If this payment is made at 11:45 a.m., Backpage will take both Bob’s and Chainalysis’ payments and put them into a central wallet. The blockchain will show both Bob’s and Chainalysis’s Bitcoins going into the same wallet, revealing Backpage’s wallet address. Since Chainalysis knows it made a payment to Backpage, they also know that Bob also made one to Backpage. This way, Chainalysis finds the wallet addresses associated with Backpage and with people like Bob who purchased features.

But not all ads on Backpage are from traffickers. Thousands of new ads are posted every week and subtle code words are often used to signal trafficking activity without calling attention to the ad. To find potential illegal activities or hunt for a particular victim, these ads must be manually examined, straining law enforcement’s resources.

To filter illicit from innocuous ads on Backpage, the researchers used a machine learning classifier to group ads by author through their writing style, acting as a digital handwriting analysis. If the algorithm found that one wallet has purchased multiple ads in different states selling different women, then the researchers believe they have found a trafficker. Using Chainalysis, these ads were then traced back to a wallet.

Their algorithm was very successful. “There were six wallets,” Doefler says, “that were pretty easy to sit down and say those are trafficking organizations.” These organizations had posted more than 50 ads in at least two different states, and spent more than a thousand dollars for those ads. The information obtained in the study was forwarded to law enforcement. Finding these relationships between advertisements and tracing them through the blockchain was a big step in the fight against human trafficking.

Their research provides “an opportunity for us to look at the underbelly of the Internet,” says Huang. Bitcoin has allowed these transactions to happen, pseudonymously and online, but the blockchain makes the transactions susceptible to tracking and study.

These techniques can be extended to other transactions. “We happened to use this methodology to dig up what we are sure are human trafficking networks, but the same methodology applies to anyone using Bitcoin,” says Doefler.

Along with Berkeley’s efforts, startups are developing similar tools to help law enforcement better combat cryptocrime by tracing transactions through the mempool and the blockchain. The IRS uses tools like Chainalysis to go after tax evaders, the FBI is targeting money launderers, and the Department of Homeland Security has been investigating cryptocurrencies’ use in the illegal drug market. Bitcoin may have once been a safe haven for criminals, but these new tools are slowly leaving them with fewer places to do business.

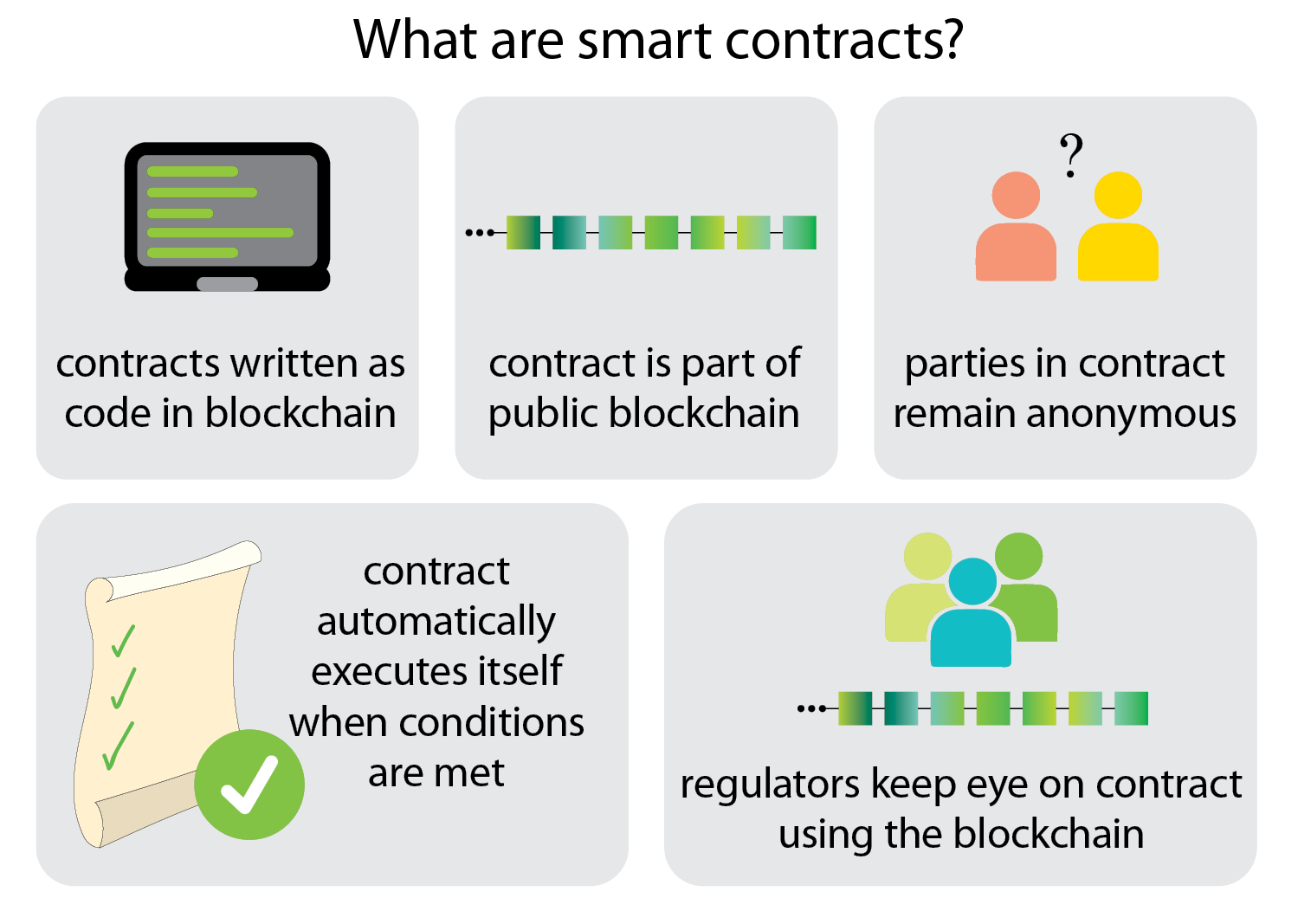

Although cryptoeconomics was the first beneficiary of the blockchain, almost every industry has been reconsidering their operations in light of this new technology. Tu says, “It is difficult to say how pervasive blockchain will be, especially given that innovation in the industry is happening every day.” But blockchains have already evolved beyond only a safe storage place for information. They can also be coupled with self-executing programs called smart contracts which are like if-then statements in a programming language. When a certain condition is triggered, they automatically execute a pre-programmed response.

For example, Mary wants to buy a camera from Ebay, but she doesn’t trust the seller. So she establishes a smart contract between the seller and herself. First, she puts her money in a neutral wallet. Then the smart contract follows the camera’s FedEx tracking, and once the package has arrived at Mary’s house, it then releases her money from the wallet and pays the seller.

Conventional contracts require a third party like a lawyer to write and verify the contract, which often involves fees. But smart contracts allow interactions to occur with guarantees, without either party being trustworthy, and for free. The blockchain coupled with smart contracts has already made a big impact, especially for renewable energy.

Decentralizing the renewable grid

California set a goal to obtain 50 percent of its energy from renewable resources by 2030. The International Renewable Energy Agency predicts energy sources like solar and wind will be cheaper than fossil fuels by 2020, and companies across the globe including Apple, Facebook, and Google are committing to 100 percent renewables.

Currently, the generation and distribution of electricity is based on centralized power plants delivering electricity in a one-way direction to consumers. However, independent owners are now using smaller, renewable power sources such as rooftop solar panels. By interconnecting these smaller power sources, known as distributed energy resources (DERs), they can form a smart grid which allows for more communication between the electricity provider and consumer, offering more flexibility than a conventional power grid.

But connecting all these smaller sources is often inefficient and complicated. Eric Munsing, a graduate student at UC Berkeley in the Energy, Civil Infrastructure, and Climate group, studied how to make DERs more scalable and efficient. “There is a very strong interest in being able to develop algorithms that can scale up to millions of devices,” Munsing says, “and you can’t have one central computer coordinate so many devices.” Eric Munsing and Jonathan Mather, another UC Berkeley graduate student, saw connections between this problem and the decentralized way blockchains and smart contracts operate.

Let’s say Tom has a smart contract to purchase solar energy whenever it is available at a desired price X, and Jim has a solar panel which adds electricity to the grid and charges X amount for it. When both of these instances happen at the same time, the smart contract will automatically buy electricity from Jim and sell it to Tom.

These self-executing contracts are stored on the blockchain, recording that Tom purchased electricity from Jim. Once the contract is in place, nobody controls it and everybody can see it, guaranteeing fair and automatic payments without a central authority.

In the system Munsing and Mather developed, each household in the network installs a smart meter which tracks the energy usage and develops an efficient energy schedule for that house. The smart meter for each household performs its own optimization, decentralizing the computation. Then all the meters synchronize to determine the best energy distribution for everyone given the physical constraints of the grid. A utility company would normally be in charge of this task, but, as Munsing explained, their algorithm would instead “delegate that responsibility to all the participants by using this decentralized algorithm and use the smart contract to bring them into consensus while ensuring the security of the system.”

For transparency, the conclusions reached by the smart meters are recorded on the blockchain, and billing and payments are handled by a smart contract for anyone to check and verify. This system can be implemented on an entire city, continuously adjusting to changing data or added smart meters.

Public blockchain ledgers and smart contracts can be used to network the energy grid and execute transactions. Small power sources, such as individual households producing solar energy, are interconnected with a smart meter that regulates and optimizes energy transactions. Credit: Nicole Repina.

Public blockchain ledgers and smart contracts can be used to network the energy grid and execute transactions. Small power sources, such as individual households producing solar energy, are interconnected with a smart meter that regulates and optimizes energy transactions. Credit: Nicole Repina.

The future of the energy sector may be this peer-to-peer trading, and communities are starting to realize it. In Brooklyn, a smart electricity grid allows residents to become more environmentally friendly and self-reliant. It is designed to supplement the conventional grid and in the case of a disaster, like in 2012 when millions lost electricity due to Hurricane Sandy, it can run parts of the city by itself. Such a union between conventional power grids and smart grids would make electrical systems more resilient to future natural disasters.

This concept has spread to other countries. In Bangladesh, 65 million homes are not connected to the central grid. A small fraction of these houses generate power from solar panels. A startup called SOLshare connects houses with solar panels to those without and establishes a blockchain-based trading system to more evenly distribute the available electricity. In Germany, the transmission system operator TenneT is collaborating with the battery supplier Sonnen to build Europe’s first distributed energy resources network.

What started off as the underpinnings of Bitcoin have evolved to making renewable energy resources more scalable. Other sectors like healthcare and the music industry are also implementing their own applications to track patient records and songs, but electronic voting is one application that is ready for a new idea.

Changing the way we vote

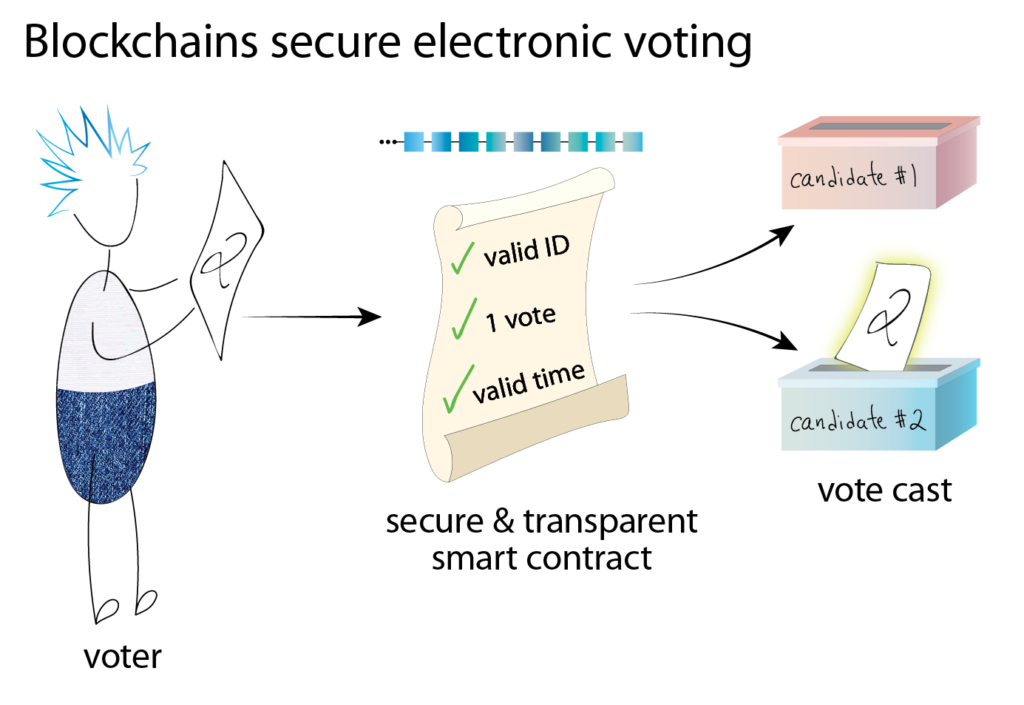

In 2016, the Department of Homeland Security revealed that Russia had attempted to hack into the voting systems of nearly half of the states in the US. The extent of their success is still under investigation, but this attack has brought voting security into the spotlight. At the Las Vegas hacking conference DEF CON 2017, a dozen digital voting machines, some of which were still being used in elections, were displayed. In an attempt to uncover, and then fix, voting systems’ weaknesses, attendees were given free rein to hack into them. Within minutes, serious vulnerabilities were discovered. If the hackers at DEF CON had breached the 2016 presidential election voting systems’ securities as they had at the conference, vote totals or individual votes could have been changed. With some voting systems not leaving a paper trail, these changes would have been undetectable. Fears of such security risks have hindered the implementation of a large-scale electronic voting system, but blockchains and smart contracts offer a significantly more secure system for implementing new electronic voting methods.

To vote on a blockchain, each voter is issued a token into their wallet. When they cast their vote, they transfer their token to the wallet of the candidate they want. Attached to the vote is a smart contract which requires that the vote take place within a certain time frame, is signed by the voter, and is verified by the polling station to prevent fake voter wallets from making illegitimate votes. The smart contract ensures that only one vote token is cast per wallet: one individual, one vote.

To prevent any discrepancies and promote transparency, the vote tallies would be publicly available on the blockchain. Rather than using an individual’s name, their votes can be identified by their wallet address which would ensure privacy and help prevent voter suppression. Voters can check that their vote was counted by searching for their wallet address on the blockchain. Fake votes cannot be cast, and votes cannot be altered after-the-fact

Companies, cities, and countries are now starting to turn towards blockchain-based voting. The first blockchain-coupled, countrywide voting occurred in Sierra Leone’s hotly contested presidential election in March of 2018. 70 percent of the votes were recorded on a blockchain for voting verification and integrity. In countries like Sierra Leone that have a history of violent elections and are plagued by government corruption, use of the blockchain is a promising push towards election fairness and transparency.

In 2016, the Utah Republican caucus allowed citizens to vote for their presidential nominee online with votes recorded on a blockchain, and around 60,000 Republicans participated in the online voting system. Even Russia, which itself participated in election hacking, is testing out a blockchain-enabled voting system to help minimize fraud. Now citizens in Moscow can electronically vote for city-wide initiatives using a preexisting app called Active Citizen, which is coupled to the blockchain. Citizens will be able to vote for urban design programs, public transportation routes, and other city management decisions. Given current concerns of election meddling and voter fraud throughout the world, incorporation of blockchain technology offers a solution to an age-old problem.

Each vote in an election can be recorded on a public blockchain for increased security and transparency. Smart contracts encoded within the blockchain automatically ensure the validity of the cast vote while preserving voter anonymity. Credit: Nicole Repina

Each vote in an election can be recorded on a public blockchain for increased security and transparency. Smart contracts encoded within the blockchain automatically ensure the validity of the cast vote while preserving voter anonymity. Credit: Nicole Repina

Despite its youth, blockchain technology boasts incredible potential. While many only know its application to Bitcoin, its uses can be far more diverse. Certainly these systems are not without potential flaws, as detractors are quick to point out, but the blockchain is still a new technology. As its popularity grows and its applications become more widespread, we will see how individuals, companies and governments adapt and respond to it. For better or for worse, the blockchain has the potential to fundamentally alter the way people interact, representing a shift away from central authorities towards peer-to-peer institutions. What started long ago as the dreams of underground cypherpunks has now grown into a ubiquitous technology that may eventually permeate every aspect of our lives.

Kelly Swanson is a graduate student in physics.

Design credit: Nicole Repina

This article is part of the Spring 2018 issue.