In the golden days of the microcomputer revolution, highly skilled scientists brought the Bay Area fame as an epicenter for technological innovation. Over the years, advances in hardware have given rise to advances in software, such as games and mobile apps. These tech success stories sometimes have a more “trivial” quality than Silicon Valley’s foundation in basic research and the sciences, leaving many with a lingering question: Is anyone still doing the same type of hard-fought, research-intensive work that started the silicon revolution?

Fortunately, a new kind of entrepreneur is now emerging to fill the shoes of Silicon Valley’s original trailblazers—armed with technical PhDs rather than MBAs. More and more academics are making the leap from the Ivory Tower into the world of business, rapidly growing a new, dynamic landscape of academic entrepreneurship. Hosting numerous resources for scientists hoping to make such a leap, UC Berkeley is becoming a premier gateway into the realm of science-based startups. Welcome to Cyclotron Valley.

Spot the differences: The scientist versus the entrepreneur

Understanding why entrepreneurship is growing in one of America’s most hallowed academic institutions requires understanding the career choices that academics currently face. As academic professorships dwindle and graduate student interests diversify, it is no longer true that a PhD can only be used as a stepping-stone on the road to academia (see “Oh, the places you’ll go”, BSR, Fall 2013). Fortunately, the skills painfully gained during PhD candidacy have wide applications beyond the confines of the university. The life of an academic researcher and that of an entrepreneur are more similar than you might think.

If there’s one thing that unites entrepreneurs and academics, it’s that they work hard—really hard—and are constantly tasked to solve a wide variety of problems. “In many respects, academics make wonderful entrepreneurs: they’re accustomed to resolving uncertainty, they’re familiar with building and testing hypotheses, and they’re versatile and multi-talented,” says Peter Fiske, a PhD and MBA who is now CEO of PAX Water Technologies, which develops technology for water quality improvement. While the end product of the academic lab and the startup are very different, each requires individuals to push themselves to the limit of their knowledge, time, and energy. “We actually find that PhDs and academics are much better suited for entrepreneurship than MBAs, as they come very lean in mindset and are able to do a wide variety of things,” Fiske explains. All of those hours spent in the lab are good preparation for the legwork needed to build a company from scratch.

Peter Fiske, Haas MBA and CEO of PAX Water Technologies believes that PhDs are very well suited to entrepreneurship.

Peter Fiske, Haas MBA and CEO of PAX Water Technologies believes that PhDs are very well suited to entrepreneurship.

Both research and entrepreneurship also require another crucial skill—flexibility. The academic must choose from many potential research paths and be prepared to alter his or her plans when experiments predictably don’t work. In the parlance of Silicon Valley, this is known as the pivot—an attempt to assess the validity of your current direction and then use that knowledge to devise another idea that works better. Entrepreneurs such as Fiske claim pivoting to be crucial to the success of any small startup: “One hundred percent of the time, an initial idea has to make a pivot, and you have no idea of what is valuable until you get out and talk to people, especially when you come from academia.” Pivoting comes hand in hand with another important skill: iteration. In science, iteration involves repeating an experiment over and over, making tweaks until the experiment works. Simply put, both the entrepreneur and the scientist must be ready to fail early and fail often. As inventor Thomas Edison purportedly wrote, “I have not failed. I’ve just found 10,000 ways that won’t work.”

While entrepreneurship and academia share many of the same struggles, they share a key benefit: the freedom to follow a personal vision. “The reality is that there isn’t enough funding for curiosity-based science,” says Jill Fuss, a former researcher at LBNL who ventured into the entrepreneurship world to start her company, CinderBio, which produces industrial cleaning enzymes from microbes living in the most extreme environments on the planet, like volcanic springs. For those who wish to carve out their own path through discovery, entrepreneurship may offer an alternative to dwindling academic options. But if academia and entrepreneurship are so similar, what are the challenges to bringing your research from the lab to the startup?

Bumps in the road

In spite of the significant overlap between the lives of entrepreneurs and academics, there are also key differences. Most of these revolve around three main points: management, communication, and culture.

We’ve all heard the stereotype of the dedicated scientist who can’t explain their work to their peers, much less a lay audience. Though this might not seriously hinder an academic career, it becomes much more problematic outside the Ivory Tower. While the scientist excels at bolstering detailed claims using painstakingly collected data, the entrepreneur must be a master of the elevator pitch. This form of short, clear communication is often overlooked in the scientific community, but there are many avenues for learning it in academia. Organizations that aim to communicate scientific research to a broader audience are a great resource for jargon-happy scientists hoping to soften their technical delivery.

Even if academics know how to communicate effectively with the outside world, they often don’t know how to navigate the murky waters of networking. Many scientists dread being scooped, or beaten to the scientific punch by a competing lab that publishes first. As a result, academics are often highly guarded when talking about their work to others. However, in the world of entrepreneurship, it is common to present even half-baked ideas, while omitting key specific technical details in order to solicit feedback and understand an idea’s likelihood of success. Networking and broadly sharing new ideas are crucial to success in the startup world. As Fuss explains, “growing a network is essential, as well as learning the jargon used in the startup world.” She also highlights the importance of presentation skills, including elements often considered unnecessary in academia, such as graphic design. These skills might be picked up by taking classes or participating in organizations that focus on communication, journalism, and data science.

Finally, there is the poorly-defined culture shock that comes with leaving the bubble of academia and entering the world of business. This may be reflected in a simple lack of business acumen. For example, scientists often suffer from misconceptions about the size of a market for an invention, or the likelihood that it could go to production. Fortunately, most modern universities like UC Berkeley have a variety of organizations and administrative offices equipped to teach the language of the business world.

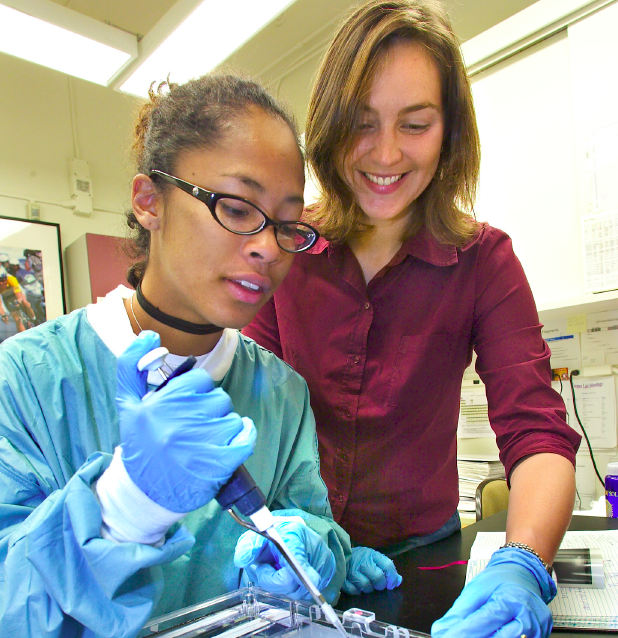

Jill Fuss(right) is co-founder at CinderBio, a startup that blossomed out of a summer project at Lawrence Berkeley National Laboratory.

Jill Fuss(right) is co-founder at CinderBio, a startup that blossomed out of a summer project at Lawrence Berkeley National Laboratory.

To help evaluate the feasibility and the market potential of a product, it is often a good idea to team up with someone more business-oriented. “Starting a company is not innate, there are many things that scientists need to learn,” says Peter Minor, co-founder of the CITRIS Foundry, an organization at UC Berkeley that supports early stage startups. Yet Minor is optimistic about scientists’ ability to succeed, explaining, “I’ve noticed that when scientists receive the proper training, [they] form incredible entrepreneurs.” Nevertheless, for would-be entrepreneurs, there is no single route to success.

From bench to business

For scientists aspiring to enter the world of business, the road to entrepreneurship may not be straight, but a good idea can go far. Take Will Hubbard, who studied industrial engineering and economics at Berkeley. During a class, he met soon-to-be cofounder Brian Kim, and after a few conversations they had the “aha!” moment that led to their company. “We saw the potential of this new technology to provide low-cost, low-power sensors,” Hubbard describes. They took their skills out of the lab and started ChemiSense, a company that makes portable sensors to detect air pollution.

The two turned to the resources available at Berkeley, building a company while simultaneously completing their studies. They joined an incubator called VentureLab, a collection of early-stage companies and experienced advisors that provide seed funding, training, and an environment where startups can thrive. Hubbard and Kim also obtained a business certificate from the Berkeley Center for Entrepreneurship. The center gave them the tools and experience needed to accelerate the growth of their company once their research was finished.

Yet despite these resources, fully benefitting from Berkeley’s entrepreneurial programs required some digging. “There were many resources, but they were spread all over the place,” Hubbard says. Fortunately, in recent years a number of organizations have sprung up to connect students with those resources. Today, ChemiSense is a member of the California Institute for Quantitative Biosciences (QB3) Garage at Berkeley, an incubator that provides equipment and lab space for research-intensive startups. As Hubbard explains, “The resources that QB3 provided, both in terms of the physical materials and the people we’ve come to know along the way, have helped a tremendous amount with growing our technology, product, and company.”

The science behind Cinderbio, on the other hand, grew out of a short-term academic project that Jill Fuss oversaw. “The project was initially given to a summer student co-mentored by me and the other co-founder,” Fuss recalls. The project entailed the study of exotic microbes and was funded by the Department of Energy. After years of research, Fuss explains that “[we were] amazed to see how active and stable were the enzymes [we] produced.” However, their grant was coming to an end, and “after the money from the grant ran out, we decided to continue the idea and start a company.” They realized that the enzymes they were using in their research were resilient enough to be used to cleanse toxic chemicals in harsh, industrial conditions. Cinderbio then applied to startup competitions and received enough advice and cash prizes to get off the ground.

But what happens when there isn’t a clear, direct path to a successful company? Many scientific startups show promise but require years of painstaking, costly research to develop their product. The delay between early-stage research and profit is even referred to as the Valley of Death, and it can stop a budding company in its tracks. Because traditional investors favor projects that become profitable quickly, there is a vacuum of support for these highly technical projects.

To help bridge the Valley of Death for nascent startups, Lawrence Berkeley National Laboratory hosts several facilities that allow the free use of their resources, such as the Advanced Light Source or the Molecular Foundry, by mid-stage startups that have submitted a business proposal. In fact, national laboratories are legally obliged to foster economic activity for the public good alongside their pursuit of scientific knowledge. Last year, a new program called “Cyclotron Road” was launched at Berkeley Lab to support entrepreneurial scientists who are developing energy technology ideas that are beyond the academic research phase but still too risky to attract funding from investors. Cyclotron Road is effectively the reverse of a traditional “spin out” model; prospective founders “spin in” to the National Lab, where their technology is developed using research-grade facilities alongside experts in the field. The hope is that this environment will improve the chances of nascent technologies succeeding in the marketplace. “The program was developed as an impulse response to what was happening in the marketplace for research and development,” says Sebastien Lounis, co-founder and director of communications at Cyclotron Road. “In the mid-2000s, there was a huge influx of venture capital into all kinds of early-stage cleantech start ups, but very few ended up being successful using that financing model.” As this funding began to dry up, it created a need for an organization like Cyclotron Road. As Lounis puts it, “To solve the biggest problems, we also need a home for the most talented people.”

Perilous as it may be, the Valley of Death is only one of the many challenges that young companies must overcome to survive. Scientist-entrepreneurs must also navigate the unfamiliar territory of the legal system. Choices they make in early-stage incorporation paperwork can have profound implications on how they later attract future investors and pay taxes. They also need to worry about intellectual property and even visa issues, all of which impact whether a startup stays afloat. Eventually, though, even established companies must grapple with the reality of all businesses: maintaining the bottom line.

Paying the bills

The key goal for any business idea comes down to two related issues: what form will it take and how will it secure funding? Academic research destined for commercial enterprise was once deemed simple “intellectual property”, and business applications were considered to be outside the purview of universities. Consequently, UC Berkeley has had a history of selling its research ideas to pre-existing companies rather than spinning off independent companies of its own. In recent years, the university has changed directions by freeing up money to directly support entrepreneurs.

A large part of funding for early stage research ventures comes from grants such as the Small Business Innovative Research (SBIR) program. These are grants specifically designed to base a startup on ideas generated from academic research, and offer support in proportion to a company’s growth. Importantly, these grants are “non-diluting”, meaning the founder retains full ownership of the funded company. This contrasts with private funding, which is often exchanged for shares in a company. Such no-strings-attached “free money” is essential to grow a company that has yet to build a product. As Fuss’ company grew from an idea to an established startup, phase I grants from SBIR funded CinderBio’s research when the company’s earlier cash prizes ran out. As the company matures further, Fuss will apply for phase II of SBIR’s tiered funding to match CinderBio’s growth.

While university grants can be crucial during the early years of young business, sometimes this support is insufficient to drive a resource-intensive project. Regular banks will not provide loans to risky ventures, so researchers often end up resorting to private funding of their ventures. For example, “business angels” are individuals with an interest in promoting entrepreneurship in a specific area and who provide seed funding to a select group of newborn companies. Similarly, venture capitalists (VCs) are investors who take risks by investing in a larger number of young promising companies in the hopes that one will be successful. The premise is that typically one success will offset the losses of others many times over.

In contrast to the last decade’s surge of software-based startups, an increasing number of business angels and VCs are promoting technological companies on account of their “tangible assets”. These are products, infrastructure, and intellectual property that are tied to physical objects that can be sold or traded. By possessing tangible assets, newer tech companies are arguably less sensitive to the ebb and flow of the stock market. Other investors are simply motivated by the desire to give back to society and bring innovation out of the lab. “Silicon Valley initially thrived on research-heavy, capital-intensive innovation, and is now coming back to it,” says Gerry Barañano, director of the Tech Futures Group, which offers free assistance to young startups. Berkeley now has specific groups of VC and angel funds, like the Batchery, that specifically fund technology-based venture.

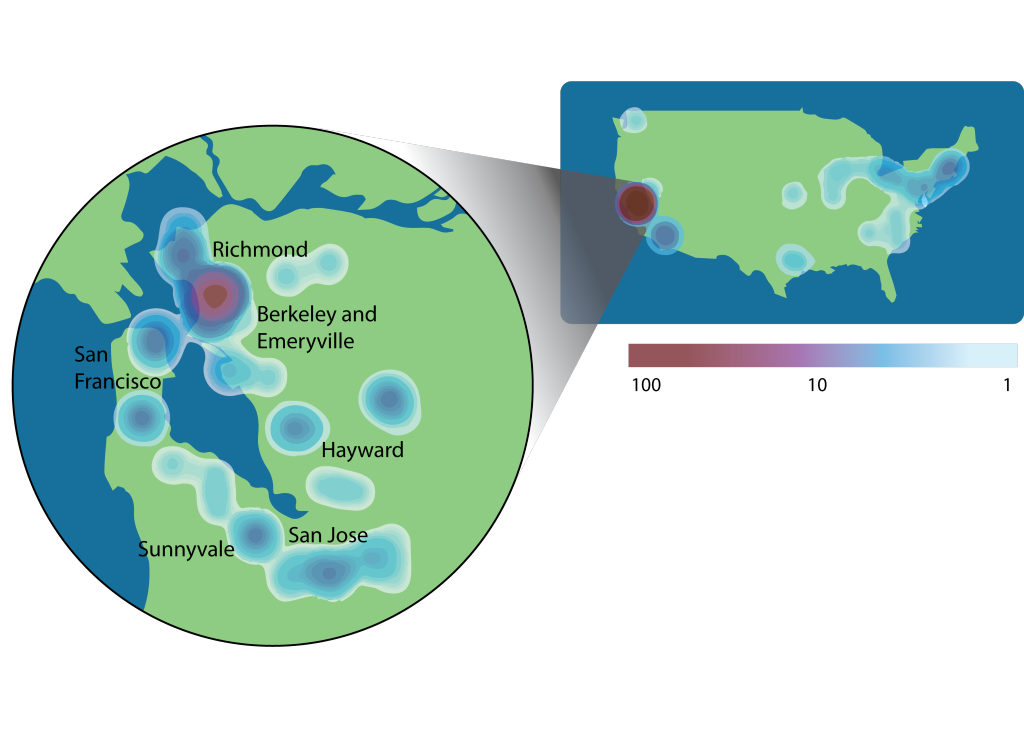

A heatmap of the number of startups with UC Berkeley-associated intellectual property reveals an interesting pattern. While many startups are located in the South Bay - the traditional Silicon Valley hotspot - there is an intense concentration of Berkeley associated startups in the East Bay. Particularly in the cities of Berkeley and Emeryville.

A heatmap of the number of startups with UC Berkeley-associated intellectual property reveals an interesting pattern. While many startups are located in the South Bay - the traditional Silicon Valley hotspot - there is an intense concentration of Berkeley associated startups in the East Bay. Particularly in the cities of Berkeley and Emeryville.

A new academic path

While it isn’t possible, or advisable, for every graduate student or postdoc to become an entrepreneur, it is important to revisit the role of entrepreneurship in the academic world. Whether it is starting a company, joining a startup in need of brainpower, or simply interacting with and learning from the business community at the university, taking an entrepreneurial approach to science can be uniquely rewarding. Minor, who has seen many graduate students become entrepreneurs, points out that “investigating entrepreneurship while investigating science is a highly synergistic experience.”

Taking one’s research out of the laboratory and into the business community will always be a challenge. In the past, this was because of cultural factors such as a lack of institutional support or an academic climate that discouraged business ventures. Now, resources within UC Berkeley and the Bay Area have given academics the tools needed to overcome these barriers, allowing them to focus on growing a successful business. While basic research will always be a core goal of the university, UC Berkeley scientists can now use their expertise to make the world a better place through business innovation as well. As Ed Zschau, a famous entrepreneur in the world of high-tech said: “Entrepreneurship is not about starting a company. Entrepreneurship is an approach to life. It is about leaving footprints.”

- Ioana Aanei is a graduate student in the department of chemistry, Chris Holdgraf is a graduate student in the Helen Wills Neuroscience Institute, and Antoine Wojdyla is a postdoctoral researcher in materials science at Lawrence Berkeley National Laboratory.

This article is part of the Fall 2015 issue.